OUR SERVICES

Relationship & Wealth Management

Relationship Management-Building Relationships

Everyone is different. Withycombe Financial Services Ltd follow a four- step process which helps us build a long, lasting relationship with clients.

The stages are:

- Getting to know you

We gather information from you on existing plans. We will discuss your plans, objectives, ambitions, hopes and aspirations. We will assess your needs. We will complete a risk profiling questionnaire which helps us build a picture of what you want to achieve. We will also discuss how you can benefit from using us and what you should expect from us in return. - Planning

Once we have assessed all of the information, we need we will explore and research various options and scenarios to make the best use of the plans you already have in place.

We’ll then advise and recommend how you can best utilise your existing plans to achieve your ultimate goal. - Implementation

After discussing all of the options available to you we will start the implementation process. We will put your plan to work. We charge a fee for doing this which is explained in our client agreement. If you do not wish us to implement our recommendation, we will charge you a fee for the hours spent and the time involved in getting to this stage. - Review

We expect our clients to review their plans at least annually to ensure they are on track to achieve their goal. We will discuss such things like fund performance, charges, tax efficiency and personal changes.

Wealth Management

What Is Wealth Management?

Wealth Management is tailored to your own individual needs. With over 37 years of experience in Financial Service’s we have the knowledge and an in-depth understanding of the intricacies of wealth. Everyone is unique and so are their requirements.

Our expert advice and the technology we have in place will help ensure we offer the most innovative ideas and solutions to help you achieve your goals and aspirations.

Investment Planning

Overview

Investing in Equities

An equity is an alternative name for an ordinary share in a company. Investing in equities means buying stocks and shares in a company listed on the stock exchange. Investors hope that rising company profits will lead to increasing dividends and growth in the capital value of the shares they hold. Historically this brings greater rewards than investing in say bank accounts or a bond. If the price of the shares increase after you buy them then you have made, on paper at least, a capital gain.

The value of shares fluctuate and go up and down. Because of the increased greater risk associated with such investments you could lose all of your investments if shares fall, likewise you could benefit considerably if shares rise.

Government Bonds

Most governments issue bonds. UK government bonds are called Gilt Edged Stock or “Gilts” and are considered to be low risk, and most secure investments available. Consequently, the interest paid by governments tends to be lower than that paid by companies. Not all governments have the same rating and the ratings and creditworthiness of some governments should always be researched. Some less developed countries have a history of defaulting on both interest and capital payments.

Non- Government Bonds

Non -Government bonds are more risky and so pay a higher return to investors than those issued by governments.

Investment grade corporate bonds

These are bonds issued by companies with good financial strength and credit ratings such as BBB- or higher from rating agencies such as Standard & Poor’s or Baa3 from Moody’s. These are considered to have an extremely low risk of default, however they are riskier than gilts but are lower risk than equities or commercial property.

Sub-Investment Grade Bonds

These are bonds that are considered to have a significantly higher risk of default and are often referred to as ‘High-Yield Bonds’ or ‘Junk Bonds’.

National Savings Investments

These are government investments purchased easily through post offices, or directly by telephone or post from National Savings and Investments. They are the least risky of investment options as they are secured by the government. The latest products and rates of interest paid can obtained by downloading a copy of the latest offering via www.nsandi.com

Individual Savings Account (ISA)

ISAs were introduced on 6 April 1999 as a replacement for Personal Equity Plans (PEPs).

ISA’s allow individuals to hold cash deposits, certain life assurance policies and investments in UK and overseas shares, corporate or government bonds. Investors do not pay income tax on any interest or dividends they receive from investments held in an ISA. No Capital Gains Tax (CGT) is payable on disposal of an ISA. An ISA investor must be a UK resident individuals over the age of 16 for cash ISAs & over the age of 18 for stocks and shares ISAs.

For the 2020/21 tax year, you can choose to pay in one of the following:

• £20,000 to a cash ISA and nothing to a stocks & shares ISA.

• £20,000 to a stocks and shares ISA and nothing to a cash ISA.

• A combination of amounts between a cash and a stocks & shares ISA, up to the overall annual limit of £20,000.

You can only open one cash ISA and one stocks and shares ISA to put new money into each tax year. You can also transfer old ISA’s in to new ISA’s.

Junior ISAs

Introduced in November 2011 to replace Child Trust Funds.

There are two types of Junior ISA, a cash Junior ISA and a stocks and shares Junior ISA and a child can have one or both types at any one time but the total annual amount which can be paid into either or both combined (if they have both) is £9,000 (tax year 2020/21).

They are long term, tax-free savings accounts for children who

- are under 18

- live in the U

- have not invested in a Child Trust Fund account.

A child cannot have a Junior ISA as well as a Child Trust Fund account, however, a Junior ISA can be opened and the trust fund transferred into it.

If the child is under 16 the account must be opened by someone with parental responsibility,

Anyone can put money into the account (providing the annual limit is not exceeded) but only the child can take it out and only then when they are 18. If they choose not to take it out or invest it in a different type of account then the Junior ISA will automatically become an adult ISA.

The money in the account can only be withdrawn before the child is 18 under two conditions:-

- The child is terminally ill, in which case the ‘registered contact’ can take the money out

- The child dies, in which case the money will be paid to the person who inherits the child’s estate.

Investing in Collective Investments

Collective Investments offer a good way to invest small sums of money because the investors cash can be “pooled” into a much larger fund allowing the scheme to invest in a wider spread of investments at a substantially lower cost than could be achieved by individual investors themselves. Unit Trusts and OEICs are very popular, common type of collective investments. They are often referred to as funds.

The assets of a unit trust is controlled by trustees. OEICs are held by an independent depository. There are many different types of funds. There aim is to target income, grow capital, or both. Specialist funds such as Ethical funds, Technology and Telecommunication funds are also available.

Unit Trusts are made up of ‘units’. Unit have both a buying price and a selling price. (Offer/Bid) The difference in these prices includes the fund management charges. The investors holding is the number of units held, multiplied by the current price.

Unit Trusts are open ended, which means that units are purchased and created every time an investor puts money into the fund. Likewise, they are liquidated when money is withdrawn.

Collective Investments

Collective investment are pooled investments. This means that your investment is pooled with others to create a large capital sum. Professional fund managers then use this capital sum to build up a large portfolio of investments. This enables you, indirectly, to hold a wide range of stocks and shares or other investments in a way which would not be practical or cost effective for the majority of individual investors to do. This process also reduces the effects on your capital of fluctuations in individual share values.

Collectives can also invest in fixed interest instruments such as UK government stock (Gilts), or Corporate bonds. Fixed interest means just that. The cost of borrowing is fixed whilst the price of the bonds may fluctuate up and down depending on supply and demand.

Fixed interest investments are regarded as being as a “safe option”. However, they do fluctuate in price. The risk associated with these types of instruments is the fact that the issuer may not be able to pay the interest (coupon) on the bonds, or the principal when the bonds mature.

Collective investment benefit from expert investment management which reduces the risk and complexities of direct investment into equities. Your money becomes part of a much larger and more diversified portfolio.

The Investment Managers will not invest all of the money. A small amount will be held in a cash fund to help pay for costs and investors withdrawals. Sometimes the Investment Managers will restrict, delay or even postpone withdrawals if they receive a high demand for withdrawals from certain funds. This can be of particular importance to investments that invest in illiquid or difficult to sell assets, e.g. commercial property.

Open Ended Investment Companies (OEICs)

This type of open-ended fund structure is the most widely recognised type of collective investment in Europe.

An OEIC works in a very similar way to a unit trust. The exception is the fact that an OEIC is legally constituted as a limited company (Plc). OEICs have been operating outside the UK for some time, but only since 1997 has it been possible to operate an OEIC in the UK.

OEICs are not trusts. They have a depository which holds the securities.

The OEIC structure allows management groups to offer umbrella funds. This gives the investor the choice of funds covering a range of investment objectives. Each sub fund will offer a different class of share within a company. Switches are a simple matter of share exchange.

Most OEICs only have one unit price and the initial charge is added as an extra. Unit trusts always have two prices, the lower or bid price is what you get when you sell back to the managers; the higher or offer price is what you have to pay when you buy.

Investment Trusts

Investment Trusts companies are amongst the oldest and most widely used types of collective investments. They are a collective investment that pools the money of many investors, (similar to Unit Trusts and OEICs) spreading it across a diversified portfolio of stocks and shares that are selected by a professional investment manager. They are publicly listed companies whose shares are traded on the London Stock Exchange.

Offshore Collective Funds

Offshore investment products include unit trusts, mutual funds or investment companies. Offshore literally means that the company will be situated in a country where the investment fund pays very little or no tax at all on any of income or gains. This allows the investor some benefit while invested, however, if the proceeds are brought back to the UK they will be taxed at that point. Offshore investment product charges are generally higher than onshore product charges and many offshore investments do not benefit from the legislative and regulatory protection available with UK authorised investments, such as the Financial Services Compensation Scheme.

Tax Planning

What Is Tax Planning?

Tax planning is the analysis of a financial situation or plan from a tax perspective. The purpose of tax planning is to ensure tax efficiency. Through tax planning, all elements of the financial plan work together in the most tax-efficient manner possible. Tax planning is an essential part of an individual investor’s financial plan. Reduction of tax liability and maximizing the ability to contribute to retirement plans are crucial for success.

Tax planning covers a number of considerations. Considerations include timing of income, size, and timing of purchases, and planning for other expenditures. Also, the selection of investments and types of retirement plans must complement the tax filing status and deductions to create the best possible outcome.

Inheritance Tax Planning (IHT)

Inheritance Tax is a tax on the estate (the property, money and possessions) of someone who’s died.

There’s normally no Inheritance Tax to pay if either:

• the value of your estate is below the £325,000 threshold

• you leave everything above the £325,000 threshold to your spouse, civil partner, a charity or a community amateur sports club

If the estate’s value is below the threshold you’ll still need to report it to HMRC.

If you give away your home to your children (including adopted, foster or stepchildren) or grandchildren your threshold can increase to £500,000.

If you’re married or in a civil partnership and your estate is worth less than your threshold, any unused threshold can be added to your partner’s threshold when you die. This means their threshold can be as much as £1 million.

Inheritance Tax rates

The standard Inheritance Tax rate is 40%. It’s only charged on the part of your estate that’s above the threshold.

Example: Your estate is worth £500,000 and your tax-free threshold is £325,000. The Inheritance Tax charged will be 40% of £175,000 (£500,000 minus £325,000).

The estate can pay Inheritance Tax at a reduced rate of 36% on some assets if you leave 10% or more of the ‘net value’ to charity in your will.

Reliefs and exemptions

Some gifts you give while you’re alive may be taxed after your death. Depending on when you gave the gift, ‘taper relief’ might mean the Inheritance Tax charged on the gift is less than 40%.

Other reliefs, such as Business Relief, allow some assets to be passed on free of Inheritance Tax or with a reduced bill.

If your estate includes a farm or woodland you contact the Inheritance Tax and probate helpline.

Inheritance Tax -Who pays the tax to HM Revenue and Customs (HMRC)

The Funds from your estate are used to pay the Inheritance Tax to HM Revenue and Customs (HMRC). This is done by the executor if a will has been made. The Beneficiaries normally don’t pay tax on things they inherit. Related taxes may have to be paid on such things as a property that have inherited where they receive rental income. Inheritance Tax may be payable if for instance you give away more than £325,000 and die within 7 years.

Wills & Trust Information

Wills

Withycombe Financial Services Ltd do not provide advice on Wills.

We can however introduce you to experts in this field who will be able to help.

What happens if you don’t make a will?

A will sets out what happens to your estate when you die and who you leave it to. Your estate is everything you own less It is a legal document which, although it can be changed after your death in some circumstances, will normally be followed as written.

Dying without a will (called dying intestate) can cause unnecessary hardship for your survivors:

• Delays would be incurred in trying to find out whether or not you did in fact leave a will, and in tracing your possessions.

• Delays would occur in the necessary formalities required before your estate can be distributed.

• Your next of kin will usually be appointed to sort out your estate, and he or she might not be the best person to do the job.

Please note that the information contained in this section relates to our current understanding of the law of England & Wales which is subject to change. Laws in other parts of the UK may differ.

Lasting Power of Attorney (LPA)

Withycombe Financial Services Ltd do not provide advice on Lasting Power of Attorney.

We can however introduce you to experts in this field who will be able to help.

THE FINANCIAL CONDUCT AUTHORITY DOES NOT REGULATE ADVICE AND SERVICES RELATED TO POWER OF ATTORNEY.

A Lasting Power of Attorney must be drawn up while you have capacity. They have no legal standing until it is registered with the Office of the Public Guardian.

A registered LPA can, unless the document states differently, be used at any time, whether you have the mental ability to act for yourself or not.

There are two types of LPA:

- Property and Affairs LPA

- Personal Welfare LPA

Trust Information

THE FINANCIAL CONDUCT AUTHORITY DOES NOT REGULATE TAXATION & TRUST ADVICE.

A trust is a way of managing assets (money, investments, land or buildings) for people. There are different types of trusts and they are taxed differently.

Trusts involve:

- the ‘settlor’ – the person who puts assets into a trust

- the ‘trustee’ – the person who manages the trust

- the ‘beneficiary’ – the person who benefits from the trust

What trusts are for?

Trusts are set up for a number of reasons, including:

- to control and protect family assets

- when someone’s too young to handle their affairs

- when someone cannot handle their affairs because they’re incapacitated

- to pass on assets while you’re still alive

- to pass on assets when you die (a ‘will trust’)

- under the rules of inheritance if someone dies without a will (in England and Wales)

What the settlor does

The settlor decides how the assets in a trust should be used – this is usually set out in a document called the ‘trust deed’.

Sometimes the settlor can also benefit from the assets in a trust – this is called a ‘settlor-interested’ trust and has special tax rules.

What trustees do

The trustees are the legal owners of the assets held in a trust. Their role is to:

-

deal with the assets according to the settlor’s wishes, as set out in the trust deed or their will

-

manage the trust on a day-to-day basis and pay any tax due

-

decide how to invest or use the trust’s assets

If the trustees change, the trust can still continue, but there always has to be at least one trustee.

Beneficiaries

There might be more than one beneficiary, like a whole family or defined group of people. They may benefit from:

-

the income of a trust only, for example from renting out a house held in a trust

-

the capital only, for example getting shares held in a trust when they reach a certain age

-

both the income and capital of the trust

Individual & Business Protection Planning

Life and Health Assurance

What Is Life Assurance?

The main purpose of Life Assurance is to provide money for those people who may depend on you financially, in the event that something should happen to you. These people could include family members or business partners.

It can provide the reassurance of financial protection for you, your family and your business associates.

A Life Assurance policy pays out a sum of money when the person who is covered by the plan dies. The money is intended to pay off any outstanding debts and support your dependants financially by providing them with a further lump sum or a regular income if you die.

Even if there are no dependants who may be financially affected by your death, some Life Assurance policies could go towards covering funeral costs.

The type of Life Assurance and the amount of cover will depend on an individual’s particular circumstances and requirements. Factors to consider will include age, dependants, level of income and financial liabilities.

Premiums are normally paid to the insurance company either monthly or annually for a fixed period of time or in some cases, until death.

Types of Life Assurance

While the overall concept of Life Assurance is fairly easy to understand, there are some complexities.

Most importantly, there are different types of Life Assurance products, covering Term Assurance, Whole of Life and others.

However, because of the many options and flexibility, Life Assurance can be a powerful instrument in your financial planning toolkit.

Please be aware that this type of assurance is based on an assessment of the health of the applicant.

The most common types of term assurance are decreasing term and level term assurance, however you can have convertible term, renewable term and increasing term assurance products

Decreasing Term Assurance

The least expensive of the Term Assurances, Decreasing Term Assurance does what it says on the label. The level of benefit decreases as the term of the policy runs; the premiums do not however reduce. The premiums are fixed throughout the policy term, and the premium level is lower than that of Level Term Assurance as a result of the decreasing benefit. This type of life assurance is commonly used to protect Capital & Repayment mortgage debt. Typically the policy reduces the protection assuming a Mortgage Interest Rate of 10%. Many are paying mortgage interest at around 5% and, providing interest rates do not go over 10%, the benefit should reduce slower than the mortgage debt, ensuring repayment of the mortgage debt in full. However, there is no guarantee that the level of cover will match the outstanding debt upon a claim.

- Provides a lump sum on death or terminal illness which can be used to cover outstanding repayments on a mortgage or loan

- The level of cover reduces each year – in line with the sum you owe

- If you die within the term of the policy, it will pay out a lump sum, to help clear whatever is outstanding on your debt at that point, however, there is no guarantee that the lump sum paid will enable you to clear your outstanding debt in full

Please be aware that this type of assurance is based on an assessment of the health of the applicant.

Level Term

Level Term Assurance

This type of cover protects you for a given term for a fixed benefit. The amount of life cover chosen at the outset will be paid whether a claim on death is made in the first year of the term or the last year. Quite often a payment would be made on the diagnosis of a terminal illness before the last 18 months of the plan, where you had 12 months or less to live. This type of protection may be suitable for family protection and Interest Only Mortgage debt, where the level of debt on the mortgage does not decrease as the years progress, however, this would depend on individual circumstances and you should seek further advice.

- Provides a lump sum on death or terminal illness to help provide a financial buffer for your family or to pay off debts

- The level of cover remains the same throughout the term of the policy

- The policy pays out if you die during the term of the policy or if, before the last 18 months of the term, you are diagnosed with a terminal illness. (A terminal illness means you are not expected to live for more than 12 months)

- Life insurance policies will only pay out once within the agreed time, so if the policy pays out because of a terminal illness claim, the policy and cover will end

- Paying out on diagnosis of terminal illness may be proportionate to the level of cover under a death claim

Please be aware that this type of assurance is based on an assessment of the health of the applicant and has no cash in value at any time.

Whole of Life

Whole of Life Policies

A whole of life policy is another policy which does exactly as it says. It covers you for the whole of your life. When the inevitable happens, providing the policy is still in force, it will pay out a death benefit. Although they can provide a surrender value, they should not be used for investment purposes due to the deductions made for the death benefit.

As payment of the benefit is inevitable Whole of Life policies tend to be more expensive than Term Assurance policies for the same level of cover (it depends on what age you are when you start the plan). Each premium is made up of a mortality element and a savings element. Upon death, a fixed sum is paid to the beneficiary along with the balance of the savings account. The performance of the underlying investment fund for Whole of Life Plans is important, as the cost of future premiums depends on fund performance.

These policies come in various forms:

- Non-profit whole life policies – A level premium payable throughout life. It pays a fixed cash sum at the time of death.

- With profit whole life policies – Same as non-profit policies but the amount paid on death is the sum assured plus whatever profits have been allocated.

- Low cost whole life policies – These have a guaranteed level of cover that the amount payable on death is the greater of the basic sum plus bonuses or the guaranteed death sum assured.

If you are worried about investment risk and increasing premiums, there are Whole of Life policies available which do not rely on fund performance, however, these do not acquire a surrender value.

Please be aware that this type of assurance is based on an assessment of the health of the applicant.

Family Income Benefit

This cover will pay out if death occurs, and provides an income per year for the term remaining on the policy. For example, for a 20 year term, where the claim occurred after five years, there would be 15 annual payments made in total. This plan has no cash in value.

The payments are not normally subject to income tax but may impact some state benefits.

Critical Illness

Insurance that pays out when a defined medical event occurs. For example, following a heart attack, stroke, cancer or some other specifically defined critical illness.

Cover is for a set term, which may be equal to a mortgage term, for when children have grown up, until retirement or another life stage milestone. It may be worth considering having one policy for a set term to cover the mortgage, and another that will provide money to help provide for your different lifestyle if a serious illness happens.

Most people choose a lump sum to be paid out. There is the option of receiving it as set income over the term remaining, which is often a lower cost option. If the plan does not have any investment element then it will not have a cash in value.

Income Protection

This provides income where you are ill or injured, and as a result your income through employment or your normal route stops. If Houseperson’s cover is included, then it will pay out upon illness or injury, irrespective of any income stopping.

It is designed to replace most of your net income. It does not have a cash in value.

Cover lasts for either a set term in whole years, or to a given age (typically your state retirement age). The amount you pay is called the premium. It can either be guaranteed not to change, or it can be reviewable. Reviewable cover normally changes based on the claims experience of the life assurance company.

Introduction to Business Protection

Every business needs to protect itself. For most businesses the most valuable asset it has is its people. Without them, a company’s survival could be at serious risk.

With that in mind we can help you take the right steps to protect your people and your business. After all, you already protect many of the important things that keep your business running smoothly, like property, fleets and stock. So you should also insure your most valuable assets: your staff and shareholders.

Pensions & raising capital

Directors may prefer to establish a separate pension plan from that of their employees. The reasons for this are that the term of their employment may be a fixed number of years, their tax position may be more complicated than other employees, or they may prefer to set up a form of self-administered scheme more suitable to their circumstances.

Directors and partners may also wish to leverage their company pension scheme at some stage to raise funding for the business. This may be a more tax and cost-efficient way of funding the acquisition of commercial property.

Key Person Insurance

Directors and employees with highly specialist skills or knowledge are key employees of the companies they work for. To lose one as a result of a critical illness or death can be damaging to the business. That is why taking out Key Person insurance to protect the company is a wise move.

Key Person insurances can provide several benefits. These can include:

- Paying the costs of a temporary replacement

- Meeting the costs of recruiting a permanent replacement

- Covering the cost of death or incapacity of a key member of staff.

The full scope of cover will depend on the type of policy purchased but companies ignore the risks of losing key staff at their peril. Shareholders, bank managers, suppliers and customers may not be so laid back.

Income Protection Insurance

If you’re unable to work because of illness or injury, under an employers group sickness scheme (Group IPI) salary is continued but is subject to tax and NI in the usual way.

The maximum amount of income you can replace through insurance is broadly the after-tax earnings you have lost, less an adjustment for state benefits you can claim. As with all insurance, it is important that you have the right type of policy which provides all that you need it to do for you.

Long-term income repayment policies usually come into play between the time when your employer stops paying sick pay, and when you collect your pension.

Shorter-term policies tend to be used to protect a mortgage, bank loan or other payment. These usually commence within a few weeks but stop entirely after 12 months or 24 months. Short-term policies often include unemployment and redundancy, unlike longer-term income protection cover which does not.

Income Protection Insurance only applies to products which pay you an income if you become unable to work due to sickness or injury. Policies to protect mortgages, loans or credit card debts are often called Accident Sickness Unemployment (ASU) policies.

Share protection through life assurance

Directors’ or partners’ share agreements may provide for the remaining directors to purchase the shares of other shareholding directors should they die. However there is a risk that the remaining directors may not have sufficient funds to hand when a fellow director passes away unexpectedly.

One solution to this is to take out life cover as a source of funding.

To arrange such cover requires the understanding and agreement of all concerned. It will also require some careful calculations to determine how much cover is required.

However, it will be a comfort to all directors or partners of a business to know that their own or a colleague’s death will leave the other directors with sufficient support to carry out the terms of their shareholders’ agreement.

This type of policy can also include critical illness for protection in the event that a director or partner is forced to leave due to illness.

Directors’ & Staff Benefits

Recruiting, motivating and retaining able staff is a key preoccupation of many businesses. Getting the rewards mix right is an important ingredient in successfully managing such staff. Remuneration menus made up of pensions, life insurance, tax efficient bonuses and benefits are common in well-managed businesses. But they require careful planning and selection depending on the type of business and the type of staff who are involved. What motivates and retains staff at an internet start-up business or a bioscience research operation may require a different balance than at a manufacturing business with a substantial production line workforce.

If staff are the keys to successful businesses then well founded and managed reward strategies are vital. Taking the right advice early on means that the right moves can be made at the outset without having to make them as the business goes along. The result should be contented and efficient staff who are confident that they are getting the most appropriate deal for their time and their labour.

Pension Planning

Retirement Planning

Why do I need a Pension?

When you retire you still need food and shelter as an absolute minimum, but of course you will want to maintain the lifestyle to which you have become accustomed, so unless you can guarantee a large inheritance or windfall, then you need to provide yourself with a secure income for the rest of your life.

A well-prepared pension plan which is regularly reviewed should go some way to providing you with a reasonable level of income in your retirement.

A pension plan requires action as soon as possible, so start now – and if you have already started, take the opportunity to have a closer look at your existing arrangements to make sure you are on track.

How much am I going to need for my retirement?

The answer to this, of course, depends on your aspirations – what will you want to do? What will be the costs of day-to-day living for you (and your partner) in retirement? What else will you want to do now you have time on your hands? What expenses will disappear, for example children or mortgage repayments?

Once you come up with a figure, add in an amount as a buffer against the unforeseen and unexpected. Now you will have arrived at the amount of pension that you should ideally be planning for. Also, bear in mind that pensions are taxable, so you will need to allow for payment of Income Tax when arriving at your final pension figure.

I already have a pension so I’ll be fine, won’t I?

It is very important that you review the benefits of your scheme and the status of your personal plan, to establish if it is on track to give you the pension you want.

If you are in an employer’s scheme you will be able to obtain a statement from either your employer or the pension provider outlining the scheme benefits. Alternatively, contact us and we can analyse your current provisions and make any recommendations with the aim of achieving your goals.

For a personal pension, the level of contributions you have been making to your scheme, investment performance and charges will determine the size of your pension, however, as the years go by, your fund should increase and could eventually get to a size where the investment returns come into play. The larger your fund, the more advice you may need on managing the fund for optimum performance, because every percentage point increase or decrease could potentially represent thousands of pounds.

We will be pleased to regularly assess your benefits to establish whether they still have the potential to meet your objectives, and make appropriate recommendations to you.

What type of Pension should I have?

There is no simple answer as this depends on your employment status, e.g. self-employed, employed or director, and the benefits that are available through your employer’s scheme, if there is one.

Occupational Pensions / Auto Enrolment

ADVICE ON AUTO ENROLMENT PENSIONS IS NOT REGULATED BY THE FINANCIAL CONDUCT AUTHORITY.

THE VALUE OF PENSIONS AND THE INCOME THEY PRODUCE CAN FALL AS WELL AS RISE. YOU MAY GET BACK LESS THAN YOU INVESTED.

TAX TREATMENT VARIES ACCORDING TO INDIVIDUAL CIRCUMSTANCES AND IS SUBJECT TO CHANGE.

Occupational Pensions

How occupational pension schemes work

Every payday, a percentage of the employee’s pay is deducted automatically from their salary or wages and invested in the scheme. The employer also contributes to the scheme on the employee’s behalf as does the government in the form of tax relief.

Two types of scheme

In a ‘defined contribution scheme’, the employee’s retirement income is based on the contributions made, whereas in a defined benefit scheme, the employee’s pension income is based on his or her salary and length of service with the employer. Most occupational pension schemes are defined contribution schemes.

What happens if the employer goes out of business?

Whether the scheme is managed by insurance companies or by the employer, the pension funds are not available to creditors of the employer, so employees’ pension pots should not be affected if the employer goes bust. If the scheme is a trust-based scheme, employees will still get their pensions, although not as much because the scheme’s running costs will be paid out of members’ pension pots rather than by the employer.

Auto Enrolment

Under ‘Automatic enrolment’ rules, any employer (with at least one member of staff) must automatically enrol every employee between the age of 22 and State Pension age and earning in excess of £10,000 a year (2020/21 tax year) into a ‘Workplace pension scheme’.

Contribution costs

The minimum contribution for employers is 3% of the employee’s earnings, whilst employees are obliged to contribute a maximum of 5% of their earnings before tax.

Annuities

THE VALUE OF PENSIONS AND THE INCOME THEY PRODUCE CAN FALL AS WELL AS RISE. YOU MAY GET BACK LESS THAN YOU INVESTED.

TAX TREATMENT VARIES ACCORDING TO INDIVIDUAL CIRCUMSTANCES AND IS SUBJECT TO CHANGE.

(From April 2015, the rules involving annuities and income drawdown changed. Rather than having to purchase an annuity, pension savers can, if they wish, withdraw as much as they wish from their pension pots. In total, 25% of the pension pot can be taken free of tax; the balance being subject to income tax. Although this change may make annuities less attractive for some, many still prefer the security of knowing they have a guaranteed and secure income for life.)

What is an annuity?

An annuity is a contract between an insurance company and a pension scheme member, where the member uses some or all of their pension savings to purchase a regular and guaranteed income for the rest of his or her life or for a predetermined number of years.

The factors that determine the amount of income you can expect to receive include (but are not limited to) your age, state of health, your postcode, prevailing annuity rates, the type of annuity you buy and the size of your pension fund.

What are the advantages of an annuity?

• A regular and secure income for life (or a selected term)

• Can be tailored to meet specific individual needs and circumstances

What are the disadvantages?

• The income you can obtain will depend on the annuity rates that are in force when you decide to take your pension benefits and it is not possible to predict what they will be or whether they are higher or lower than current rates.

• Payments cease on death (unless you purchase an annuity which continues to pay income after you have passed away)

Depending on your circumstances and requirements, some annuities may be more suitable for you than others. We are here to assist and to ensure that you purchase the annuity that best suits your needs and circumstances.

Important note

If you do decide to buy an annuity upon retirement, you should ensure that you check policies, rates, restrictions, and benefits very carefully, and if necessary, seek advice from a financial adviser. Investing in the wrong annuity scheme could cost you a great deal in annual income, so make sure that you look into this subject carefully before you make any commitment.

THE VALUE OF PENSIONS AND THE INCOME THEY PRODUCE CAN FALL AS WELL AS RISE. YOU MAY GET BACK LESS THAN YOU INVESTED.

TAX TREATMENT VARIES ACCORDING TO INDIVIDUAL CIRCUMSTANCES AND IS SUBJECT TO CHANGE.

National Employment Savings Trust (NEST)

NEST — is regulated by the Pensions Regulator. It is a defined contribution workplace pension scheme — was set up by the UK government to facilitate auto enrolment. As a ‘qualifying’ scheme, NEST can be used by any and all UK employers to make pension contributions. Employers can auto enrol employees in NEST rather than setting up their own pension scheme.

Members can transfer other Defined Contribution pensions they may have into their Nest scheme, should they wish, and are also free to transfer out to another pension scheme, providing they have stopped making contributions into the NEST account.

Although Auto Enrolment is compulsory, membership of NEST isn’t. NEST is, by design, a very simple scheme. Employers with more sophisticated requirements are free to consider establishing other types of workplace/occupational pension schemes/group personal pension plans.

Key considerations for employers:

- Which type of scheme are you offering your staff?

Look at the advantages and disadvantages of other employer pension schemes when compared with the NEST scheme. A number of providers still offer Group Personal Pension Plans. We can help you research the market and analyse what is available. You can then make an informed decision and decide which plan is more suitable for your organisation. We can also help with promoting the scheme to your employees A combination of two schemes may be the most appropriate approach initially, with staff eligibility for different schemes contributing to the solution; e.g. senior and employed staff being enrolled into an occupational scheme and contract staff being enrolled in NEST. - Cost

Employers have to contribute 3% of every employees’ ‘qualifying earnings’ to their occupational pension scheme, which will have a considerable impact on the costs of the business. If you offer a higher contribution you have to plan for this additional cost and the long-term implications of enrolling all staff on this basis. Look at whether you are making contributions on the full salary amount or band earnings. The key is to budget for these newly introduced measures, so that larger pension contributions do not make a sudden impact on costs. Employers may consider reviewing their total remuneration package in order to absorb these extra costs. Employees have to pay 5% of their qualifying earnings. The total contribution is therefore 8% (2020/21) - Review your current internal software systems and payroll package to make sure they can cope with the additional administration.

- Effectively communicate these changes to your staff

Consider how you are communicating these changes to your staff. It is important to try and engage employees with their pension. Pensions are a valuable benefit. A pension scheme is viewed by many employees as an essential part of their benefits package, and when offered as part of the overall remuneration, can add tremendous perceived value to an organisation and the way it views its employees.

Organisations that provide pension schemes above the standard laid out by the government are likely to be a more attractive proposition for new and existing employees and demonstrate a commitment to their workforce.

Personal Pension

THE VALUE OF PENSIONS AND THE INCOME THEY PRODUCE CAN FALL AS WELL AS RISE. YOU MAY GET BACK LESS THAN YOU INVESTED.

TAX TREATMENT VARIES ACCORDING TO INDIVIDUAL CIRCUMSTANCES AND IS SUBJECT TO CHANGE.

Personal Pension Plans

A personal pension plan helps you save money for retirement and is available to any United Kingdom resident who is between the ages of 16 and 75 (Children under 16 cannot start a plan in their own right but a Legal Guardian can start one on their behalf). You, in conjunction with your adviser, choose the pension provider and make the arrangements for paying the contributions to the plan.

You can start a personal pension even if you have a workplace pension or if you’re self-employed and don’t have a workplace pension. You don’t have to be working to take out a Personal Pension Plan and you can also provide a Personal Pension Plan for your spouse/partner or your child/children.

When you contribute to a Personal Pension plan, your money is invested by the pension provider (usually an insurance company) to build up a fund/pension pot over a number of years.

Tax relief

If you’re a basic rate taxpayer, your pension provider will claim back Income Tax at the basic 20 per cent rate on your behalf on the contributions you make and add it to your pension pot. Higher rate taxpayers claim the additional rebate through their tax returns.

Contribution limits

The total amount (the ‘annual allowance’) you or your employer can contribute to a defined contribution personal pension scheme, or schemes, is limited to £40,000* per annum or your annual salary, whichever is lower. If you contribute more than that you will pay a tax charge. Your pension is also subject to a ‘lifetime allowance’ which is the total value of pension savings you can have before incurring a tax penalty. This figure is currently £1,073,100*.

Tax-free cash

Most schemes allow you to withdraw 25% of your fund tax-free from age 55 onwards. Subsequent withdrawals are subject to income tax.

The size of your pension pot will depend on:

• the amount of money you paid into the plan

• the performance of the plan’s investments

• charges payable under the plan

• advice charges (where applicable)

Taking your pension

Although most personal pension schemes specify an age when you can start withdrawing benefits from your personal pension (usually between 60 and 65) you are allowed to do that from age 55 if you wish. You don’t have to stop work to draw benefits from your plan.

Death Benefits

If you die before the age of 75 and haven’t purchased an annuity, your beneficiaries can inherit the entire pension fund as a lump sum or draw an income from it completely free of tax. If you’re over 75 years of age when you die, there will be tax to pay on any withdrawals made by the recipient of your fund.

*Tax year 2020/2021

SIPP

THE VALUE OF PENSIONS AND THE INCOME THEY PRODUCE CAN FALL AS WELL AS RISE. YOU MAY GET BACK LESS THAN YOU INVESTED.

TAX TREATMENT VARIES ACCORDING TO INDIVIDUAL CIRCUMSTANCES AND IS SUBJECT TO CHANGE.

What is a SIPP?

A Self Invested Personal Pension (SIPP) is a Registered Pension scheme under the terms of the Finance Act 2004.

SIPPs are designed for investors who want maximum control over their pension without being dependent on any one fund manager or insurance company. As such, a SIPP requires active management and a degree of investment expertise. Furthermore, the charges (levied by the SIPP manager) may be higher than for a personal pension or stakeholder plan.

Unlike a standard personal pension, a SIPP holder has a much wider choice of assets to invest in, each of which can be selected to meet the individual’s personal circumstances and requirements.

Investments which can be held in a SIPP include:

• UK and overseas equities

• Unlisted shares

• OEICs and unit trusts

• Investment trusts

• Property and land (but not most residential property) insurance bonds

It’s possible to use a SIPP to raise a mortgage to fund the purchase of commercial property, where the rental income paid into the SIPP either completely, or partially, covers the mortgage repayments and/or the property’s running costs.

Please note SIPPs are not suitable for everyone investing into a pension, we will conduct an assessment of your situation to determine suitability.

Executive Pension Plan

THE VALUE OF PENSIONS AND THE INCOME THEY PRODUCE CAN FALL AS WELL AS RISE. YOU MAY GET BACK LESS THAN YOU INVESTED.

TAX TREATMENT VARIES ACCORDING TO INDIVIDUAL CIRCUMSTANCES AND IS SUBJECT TO CHANGE.

Director / Executive Pension Plan (EPP)

Executive Pension Plans (EPP) are tax-efficient savings plans set up by the company for key employees. The employer (and sometimes the employee) pays into the plan, to build a tax-efficient fund, which is used at retirement to provide tax free cash and a pension income. In effect, EPPs are money purchase occupational pension schemes and operate for the most part like any other pension scheme.

EPPs are normally established by company directors or other valued employees for their own benefit, though only the favoured can expect to be given the levels of investment that these schemes offer.

From an employer’s perspective, an EPP can form the core of a benefits package to attract, motivate and reward key executives, plus the financial benefits of contributions being allowable as a business expense and able to be set against taxable profits. Furthermore, there is no NIC liability and so extra pension contributions into an EPP can be made instead of salary increases.

The pension fund is set up under trust, with the trustees responsible for the trust’s day-to-day administration, such as ensuring contributions are paid regularly and benefits are paid out promptly.

For the individual, there is flexibility of retirement, allowing the person to retire early and hand over to others (although benefits can only be taken from age of 55) or to work well past the company’s normal retirement date.

SSAS

SSASs ARE REGULATED BY THE PENSIONS REGULATOR.

THE VALUE OF PENSIONS AND THE INCOME THEY PRODUCE CAN FALL AS WELL AS RISE. YOU MAY GET BACK LESS THAN YOU INVESTED.

TAX TREATMENT VARIES ACCORDING TO INDIVIDUAL CIRCUMSTANCES AND IS SUBJECT TO CHANGE.

What is a SSAS?

SSAS — also known as a Small Self Administered Scheme (SSAS) — is a company pension scheme, the members of which are usually directors and key employees of the sponsoring employer.

Whilst subject to the same rules relating to contributions and benefits as a normal company pension scheme, SSAS’ schemes have considerably more flexibility and control over the investment policies and the scheme’s underlying assets.

Other considerations are that only one scheme is permitted per employer, normally the scheme should have less than 12 members and there can be limits on the amount of investment.

If you would like further details on any of the above plans please contact us.

State Pension

We would always advice clients to obtain a State Pension Forecast by completing form BR19 which is available online. The statement provides you with a forecast of your state pension entitlement and includes your State Pension, SERPS and any other pension entitlement such as the Graduated Pension all of which are based upon the level of National Insurance contributions you have paid during your working life. Visit https://www.gov.uk/ and click on “start now” to begin the process.

About the state pension

A State Pension is a regular payment made by the government to people who have paid or been credited with a minimum amount of Class 1, 2 or 3 National Insurance Contributions and have reached State Pension age.

State Pension Age

The State Pension age is now the same for men and women and is gradually increasing from 65 in November 2018 to 66 by October 2020. It will increase again to age 67 between 2026 and 2028.

Under the current law, the State Pension age is due to increase to 68 between 2044 and 2046. However, the Pensions Act 2014 provides for reviews of the State Pension age at least once every 5 years, taking into account a range of factors that are relevant to setting the pension age, one of which will be changes in the life expectancy of the population. Following a review in 2017, the government announced plans to bring this timetable forward, increasing the State Pension age to 68 between 2037 and 2039. At present, this is the government’s intention, and will need to be voted into law.

The State Pension is paid whether the claimant is working or not and is paid regardless of any income and/or existing savings or capital the claimant may have.

Claiming the State Pension

The State Pension must be claimed — it is not paid automatically. The claim can be made online, by calling 0800 731 78098 or by downloading a form and sending it to a pension centre. N.B. Different arrangements apply in Northern Ireland.

Payment frequency

The State Pension is usually paid every 4 weeks, in arrears, directly into the claimant’s bank or building society account.

Working beyond State Pension age

The State Pension can be claimed even if the individual chooses to work beyond State Pension age.

The State Pension may be taxable

The State Pension is considered part of the recipient’s earnings and may be subject to income tax.

Postponing the State Pension

It is not compulsory to claim the basic State Pension at State Pension age — it can be deferred until the claimant chooses to receive it. In return for ‘postponing’ his or her claim (and providing the claimant lives in the EU, European Economic Area, Gibraltar, Switzerland or any country the UK has a social security agreement with) the pension payment will increase by 1% for every 9 weeks it is deferred.

Claiming the State Pension while living overseas

Although the State Pension can be claimed while living outside of the UK, it will only be increased each year if the claimant lives in the EEA, Switzerland or in a country which has a social security agreement with the UK.

Basic State Pension on death

Any surviving spouse or civil partner that is over State Pension age and not already receiving the maximum payment may be able to increase their State Pension by using the deceased’s qualifying years. If the spouse or civil partner is under State Pension age, any State Pension based on the deceased’s qualifying years will be included when he or she claims their own State Pension.

Stakeholder

THE VALUE OF PENSIONS AND THE INCOME THEY PRODUCE CAN FALL AS WELL AS RISE. YOU MAY GET BACK LESS THAN YOU INVESTED.

TAX TREATMENT VARIES ACCORDING TO INDIVIDUAL CIRCUMSTANCES AND IS SUBJECT TO CHANGE.

Stakeholder Pension Schemes

A Stakeholder Pension (SHP) is a type of Personal Pension Plan designed to provide an optional lump sum and income in retirement. In common with a Personal Pension Plan, Stakeholder Pensions are available to any United Kingdom resident under the age of 75.

You, in conjunction with your adviser, choose the pension provider and make the arrangements for paying the contributions to the plan.

You can start a SHP even if you have a workplace pension or if you’re self-employed and don’t have a workplace pension. You don’t have to be working to take out a SHP and you can also provide a SHP for your spouse/partner or your child/children.

When you contribute to a SHP, your money is invested by the pension provider (usually an insurance company) to build up a fund/pension pot over a number of years.

A Stakeholder Pension incorporates a set of minimum standards established by the government, which include:

- A capped charging structure which is a maximum of 1.5% per year for the first 10 years and 1% per year thereafter

- The minimum contribution is £20 per month

- You can pay in lump sums whenever you want

- You can stop and start payments as you wish

- You can switch to another scheme at any time without penalty

- You do not need to retire to draw your stakeholder pension benefits. You can take benefits from age 55

- At retirement, the option exists to take a quarter of the fund as a tax-free amount

The key point about SHPs, as with any other pension, is to start contributing as early as possible and keep making contributions for as long as possible. That way your pension pot has time to build up and the investment returns compound through reinvestment over many years. The result should be a significant sum of money to invest when you retire.

If you die before age 75 and you have not started to take benefits from your pension the funds will normally be passed to your spouse or other elected beneficiary free of inheritance tax. Other tax charges may apply depending on the circumstances.

It is possible to continue past age 75 without taking benefits. If you die after age 75 your pension pot can still be passed to a nominated beneficiary free of inheritance tax, however if paid as a lump sum, tax at the beneficiary’s marginal rate will apply (2020/21). If it is paid as an income to your spouse or dependant there will be no initial tax charge, but any income paid would be subject to income tax.

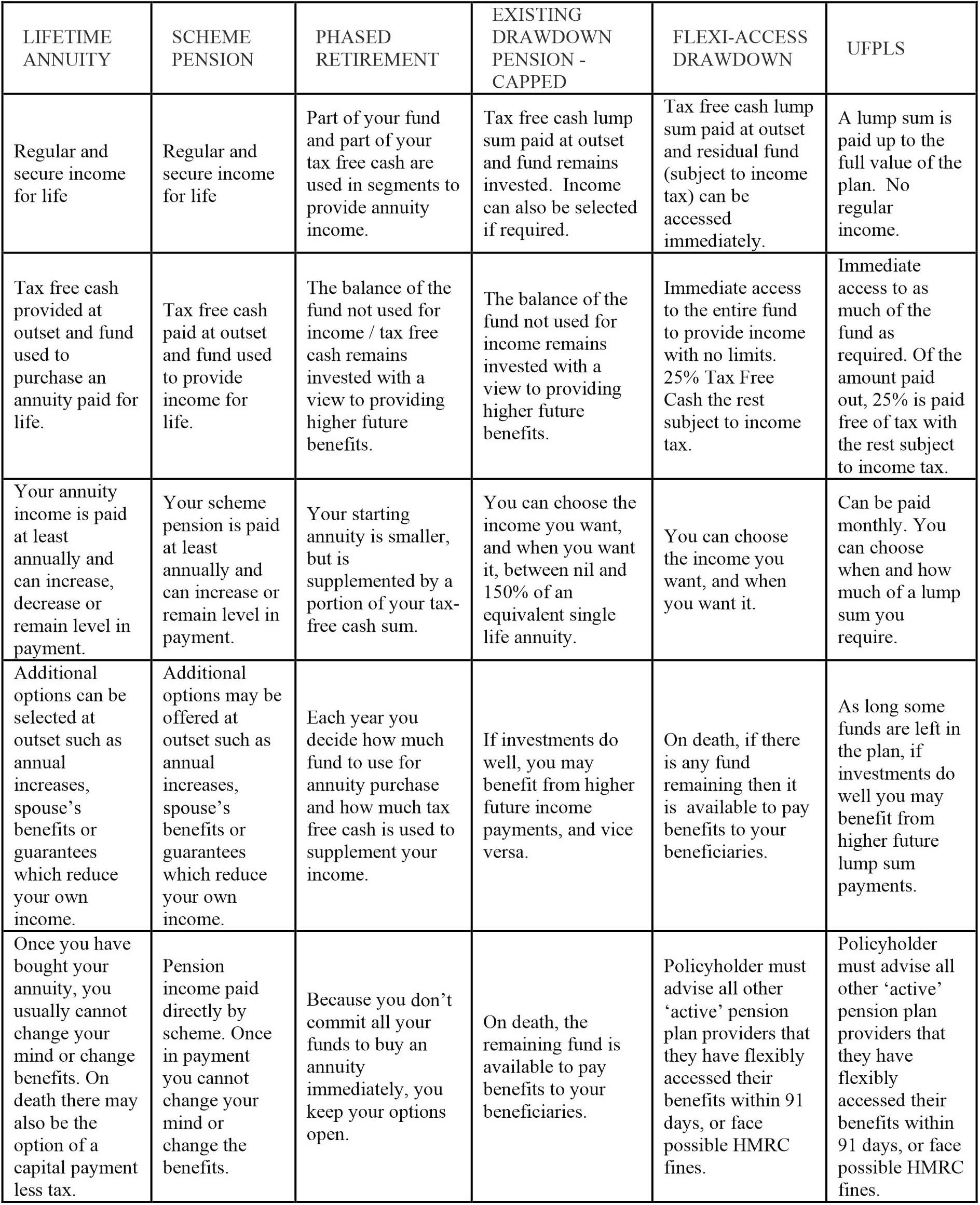

Your Retirement Options Explained

QUICK GUIDE

TAX TREATMENT VARIES ACCORDING TO INDIVIDUAL CIRCUMSTANCES AND IS SUBJECT TO CHANGE.

Pensions & Divorce

How are pensions valued on divorce?

This depends on where the divorce is taking place, eg in Scotland a pension is viewed in the same way as any other investment. Basically £1 in a pension is valued in the same way as £1 in an ISA. There is no factoring in of the eventual tax treatment when benefits are taken (i.e. usually only 25% of a pension is tax free, whereas an ISA is entirely tax free). Further to this, when the pension can be accessed is not factored in, so for divorces where one (or both) parties are below minimum pension age the £1 for £1 valuation may create issues.

In England, Wales and Northern Ireland pensions are not valued as any other investment, so the solicitors dealing with the divorce may need to engage the services of an actuary to determine the value of the pension rights in todays terms for the divorce.

Offsetting

This involved getting the value (usually the cash equivalent transfer value) of the pension benefits as at the date of the divorce (or date of official separation in Scotland). This value would then be included in the total value of the matrimonial estate to be divided on divorce.

As the courts were unable to compel the pension holder to set aside any of his pension benefit for the ex-spouse, they took account of the pension’s value by offsetting it against other assets. Effectively, the ex-spouse gets another asset, or share of another asset (up to the appropriate value of the share of the member’s pension) instead of the share of the pension. Normally, this involved the ex-spouse getting a larger share of the matrimonial home to compensate for the pension share.

Where offsetting applies, legislation has no direct impact, as these financial arrangements work outside the pension scheme.

Attachment order

An attachment order (an earmarking order in Scotland), is effectively deferred maintenance. The sequence of events leading up to an earmarking / attachment order is as follows:

The court instructs the member to get a valuation of his pension benefits.

- In Scotland, this would be the cash equivalent transfer value (CETV) of the benefits as at the date of petition, or when the divorcing couple officially separated.

- Scottish courts usually take into account only benefits earned during the marriage.

- Outside Scotland, the courts will use the same CETV basis, but there may be no proportioning by the courts for the period of the marriage. This means all pension benefits, potentially including those earned before marriage, may be taken into account (except any already earmarked from an earlier divorce).

- The pension scheme provider / trustees must provide this valuation within three months of the request.

- The court issues an order to be served on the pension provider / trustees. The provider / trustees can object to the terms of an order within 14 days of its receipt. The administrator’s / trustees’ normal discretion on selection of beneficiaries for death benefits may be over-ridden by an earmarking order. The order can compel the inclusion of the ex-spouse as a beneficiary for any lump sum death benefit. This power doesn’t extend to the redirection of dependants’ pensions on the member’s death. The overriding of the administrator’s / trustees’ discretion may result in inheritance tax issues.

- If the pension benefits are subsequently transferred, the receiving scheme or provider must be given a copy of the attachment/ earmarking order by the transferring scheme. The ex-spouse should be informed of the transfer within 21 days.

What can be earmarked in England, Wales and Northern Ireland:

- A specified percentage of the pension benefits must be paid to the ex-spouse when the member starts to draw his benefits.

- The member may have to commute part of his pension for the maximum lump sum available when benefits are taken, and pay part of that lump sum to his ex-spouse.

- A specified percentage of any lump sum death benefit must be paid to the spouse in the event of the death of the member before retirement.

What can be earmarked in Scotland:

- The court can’t earmark the pension income of the member.

- Only the tax-free cash sum and lump sum death benefits can be earmarked.

Considerations when opting for attachment orders

Attachment / earmarking provides an avenue for an ex-spouse – who may have no own-right pension provision – to access the pension built up during the marriage (or in England, Wales and Northern Ireland, before the divorce). Unfortunately, the provisions bring various disadvantages:

• Attachment orders automatically lapse on remarriage of the ex-spouse, in relation to any periodical (regular) pension payments due. Any tax-free cash lump sum attached / earmarked when the member takes benefits would still be payable to the ex-spouse unless the court order specified otherwise.

• Similarly, attachment / earmarking orders automatically lapse on the member’s death, except where the order covered any lump sum death benefit to be paid to the ex-spouse. In these cases, the terms of the order would still apply on the member’s death, even if the pension was already in payment.

• Subject to normal HMRC rules, the member can opt to take benefits whenever he decides. This could result in delaying benefits as long as possible in the hope that the ex-spouse will remarry or die first.

• The ex-spouse has no control over the investment of the pension fund. The member could deliberately invest in poorly performing funds to diminish the value of the fund.

• Contracted-out rights can’t be earmarked, but can be used in the value for offsetting purposes.

• The pension is taxed as the member’s income and attached / earmarked payments are paid after tax. For this reason, pension providers are likely to require the order to specify that the member (not the provider) is responsible for the actual payments to the ex-spouse. This may, conveniently, be arranged through a joint bank account with appropriate ongoing payments to individual accounts.

• The method of valuation for divorces outside Scotland could have serious consequences for those who marry late in their working life or for those who have been divorced more than once.

• Attaching/earmarking doesn’t allow a ‘clean break’ divorce.

Pension sharing

The aim of pension sharing is to separate the ex-spouse’s pension entitlement from the member’s pension so there’s a clean break, in contrast to earmarking.

Pension sharing is available to couples divorcing throughout the UK, but isn’t compulsory.

Couples divorcing in Scotland can reach a pension share agreement by a court order or by a legally binding agreement. However, in all of England, Wales and Northern Ireland, this can only be achieved by a court order.

The pension sharing process

• The court instructs the member to get a valuation of his pension benefits CETV, along with certain other information about his benefits. If a CETV has been provided in the last 12 months, that figure can be used.

• If an up-to-date valuation is needed, the provider or trustees of the pension scheme must provide the valuation within three months (or no later than six weeks before the divorce hearing if the provider / trustees had prior notice of the impending hearing). If there’s no request for a CETV, the scheme must provide the requested information within one month. It’s important that the information request makes it clear that this is needed as part of the divorce process, so the scheme knows that these deadlines apply.

• The court will decide how much of the pension rights should be allocated to the ex-spouse, and the member’s pension rights will be reduced by a corresponding amount. This reduction is known as a pension debit.

• In Scotland, the order may instruct a monetary amount or a percentage of the pension benefit to be subject to a debit. Outside Scotland, the debit amount must be a percentage. This is particularly important given that the value of the pensions may have changed substantially from the point of separation to the point the pension debit is actioned.

• Contracted-out rights may be split.

• The rights allocated to the ex-spouse are known as a pension credit if paid from uncrystallised funds. It’s a disqualifying pension credit if this is paid from crystallised funds.

• The existing pension scheme can choose to allow the ex-spouse to join the scheme in her own right, or to take the transfer value to another registered pension scheme. In practice, it’s likely most schemes will only allow a transfer out. There are two exception categories:

where the member’s pension is being paid through a guaranteed pension annuity with a pension provider, the pension provider may insist on an annuity with that provider (remember the ex-spouse needs to meet the minimum pension age rules), and

where assets can’t be readily cashed in, the scheme may decide the ex-spouse needs to become a member of the scheme in her own name. This would apply in, for example, unfunded schemes, public sector schemes or, where the assets are in property such as in SIPPs / SSASs).

• The scheme can choose a default option where the ex-spouse is unable, or unwilling, to make a decision on where to transfer her pension share.

• Pension schemes are allowed to pass on the costs of implementing pension sharing orders to divorcing couples. The regulations don’t specify limits on the charges, but if the scheme requires charges to be paid, the scheme must notify the couple of the charges before the order / agreement is made.

Once the pension sharing order is granted

When the pension provider / trustees get a pension sharing order:

• they have three weeks from receipt to appeal against any order / agreement

• they can delay the start of the implementation period until charges are paid or while relevant information is outstanding (or while an appeal is being decided)

• they have four months to implement the pension sharing order. This implementation period involves discharging the pension debit / credit by way of an internal or external transfer.

Mortgages

Withycombe Financial Services Ltd specialise in Pensions, Investments and Protection.

To help our clients choose the right mortgage we can introduce you to a number of Mortgage Brokers who we have selected over the years because of their track record, experience, knowledge and reputation. Our “panel” of Mortgage Brokers like ourselves are whole of market, which means they are independent and can consider mortgages from all possible lenders. They are not restricted. They are fully regulated by the Financial Conduct Authority.

If you require any further information please don’t hesitate to contact us.

General & Commercial Insurance

Withycombe Financial Services Ltd specialise in Pensions, Investments and Protection

To help our clients choose the right product and cover for their individual or business needs we can introduce you to Brokers who have the products, services and relationships to provide you with a solution. Our “panel” of Commercial and General Insurers have enviable reputations and are very experienced and knowledgeable. They are whole of market, which means they are independent and not restricted. They are fully regulated by the Financial Conduct Authority.

If you require any further information please don’t hesitate to contact us.

INDEPENDENT FINANCIAL ADVISERS - CARDIFF

Get In Touch

For more details about the services we offer please contact us using the form below:

Withycombe Financial Services Ltd

Registered Office: 11 Graig Lwyd, Radyr, Cardiff, CF15 8BG

Telephone: 02920 843375

Mobile: 07917 457647

Registered in England & Wales- number: 11913945

Authorised and regulated by the Financial Conduct Authority: 842433